When sending international shipments, it’s important to consider the effects that customs Duties & Taxes will have on the total landed cost of your shipments. Depending on the commodity being shipped and the destination it’s headed to, clearance charges could be very impactful to the total cost of the shipment. The ability to calculate the landed cost of a particular shipment can save both the shipper and the recipient valuable time and effort.

Customs Duties & Taxes are imposed when good are transported across international borders and exist to generate governmental revenues and protect local industries. Duties and Taxes are assessed based on the information provided on the shipping label, commercial invoice (CI) and/or other related shipping documents.

How Customs Duties and Taxes Impact Your Shipment

In some countries, Duties and Taxes must be paid prior to the shipment being released from customs. A shipment’s duty and tax charge will be based on the following information:

- Product sale value

- Trade agreements

- Country of manufacture (COO)

- Description and end use of the product

- The product’s Harmonized System (HS) code

- Country-specific regulations

- Goods and Services Tax (GST) and Value-Added Tax (VAT)

The type of tax imposed on a shipment varies by country. Many countries have a general consumption tax which is assessed on the value added to goods and services. In some countries such as Canada, Singapore, Australia and New Zealand, this tax is known as the goods and services tax or “GST.”

For counties in the European Union (EU), the GST tax is known as a Value-Added tax (VAT). Businesses that are VAT-registered and fully taxable do not bear the final costs of VAT because it is a tax on consumer expenditure (much like Sales Tax in the United States).

For more information, please visit the European Commission (EC) Taxation and Customs Union website.

Harmonization Codes

A Harmonization Number is a specific numeric designation that the international mailing system assigns to products for the purpose of tracking items being imported into foreign countries.

Harmonization codes are generally recognized universally and are required by customs to determine the duties and import taxes that recipients must pay when their shipment gets imported into their specific country.

How Do I Find My Harmonization Code?

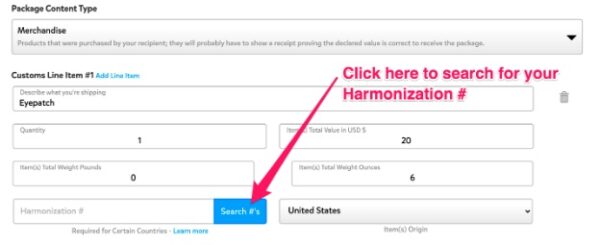

To identify your product’s Harmonization Number, you may visit the United States Census Bureau Schedule B Search Engine. From this site you can enter the details of your product into the search bar. From there, you can search Harmonization Numbers by selecting the blue “Search #’s” button in the Customs section, as seen here:

After selecting “Search #’s” you should be provided a breakdown of potential HS codes corresponding with your product. Select the most appropriate number based on the description that matches your product most closely.

How to Declare the Value of Your Goods

Customs agents use the product value(s) listed on the CI to determine the cost of Duties and Taxes. For that reason, it’s important to state the value of your goods clearly on the paperwork and ensure the cost is correct. Keep in mind that a product may be assigned different values depending on the situation, so two shipments of equal values sent six months apart could incur different charges. It’s vitally important to declare the accurate values for your goods to avoid shipment delays, or worse yet to incur costly penalties by governmental agencies.

Shipping Channel YouTube Video

What is the declared value?

- The declared value is generally quantified by the amount paid for the items being imported. For example, if you’re shipping two watches each valued at $16,000, the declared value of the items would be $32,000.

What’s the difference between commercial value, wholesale value and cost price?

- The commercial, or retail value, is the price an end buyer pays for a product. With B2C shipments, it’ll also usually be the declared value.

- The wholesale value is the price paid for a single item when purchasing in bulk. It’s also what it would cost the seller to replace a damaged or lost item. The value is also sometimes used for insurance purposes. When products have been purchased for a wholesale price, it will also be their declared value.

- Cost price is how much it costs the producer to make the item. If customs does not think the declared value is correct and has no other way to assess the item, they will use the cost price of the goods to calculate the product’s value and duties.

Which value should I declare on my commercial invoice?

- You should always declare the actual price paid and be prepared to provide customs authorities with proof of transaction.

What is the value used for?

- Customs use it to clear your goods and determine the duties and taxes.

Where do I state it?

- On the commercial invoice – and bear in mind inaccurate values are the most common reasons for customs fines, so it’s important to notate the accurate amount. Please also note that most carriers like FedEx have electronic reporting in place for customs values that transit the values of goods for a shipment to customs agents digitally.

What other details do I need to provide?

- As well as an accurate value, your commercial invoice should include an HS code and a detailed description of your shipment.

How do customs asses the value?

- To determine the value of imported goods, the customs valuation procedure is applied.

- Most customs authorities apply rules from the World Trade Organization, otherwise known as the WTO. You can get more information on the six methods they use on their website.

What happens if I provide an inaccurate value?

- Undervaluation of goods is taken very seriously by the authorities and can result in a fine or your goods being seized.

- If the customs authorities question the value you’ve provided, they may ask the receiver to provide proof of sale. To avoid this delay, your carrier or broker will ask you for evidence of sales such as a contract or bank payment.

FedEx Reference Guide – International Shipping for eCommerce

Duties & Taxes Paid v. Unpaid Elections

The final important consideration for international shipments is whether you as the merchant want to send you packages Duties and Taxes Paid versus Unpaid (DDU). Duties & Taxes Paid (DDP) means that the shipper agrees to be charged all applicable taxes and fees for a shipment. These charges are typically billed back to the sender’s account a couple of weeks after the shipment has been sent and the calculations have been completed by the clearing customs authority. The sender will get a detailed breakdown of the charges and values that were accessed on each commodity. Many eCommerce shippers send packages DDP to avoid “surprise” charges to the end retail customer. These charges represent a cost of doing business internationally and can either be absorbed by the merchant or re-couped through a charge at the time of checkout in the shopping cart.

Sending a package Duties & Taxes Unpaid (DDU) means that the recipient must pay the applicable taxes and fees to the customs authority before it will be released for final delivery. Failure to do so could result in the package either being returned to the sender or destroyed. Returned international shipments are expensive because they are subject import shipping rates which are usually more expensive that the initial export rate. The outbound shipping fees are also not recoverable, so the merchant essentially pays for the shipment twice in this case. International customers from the EU and other foreign countries are better acclimated to paying duties and taxes on shipments though given that they tend to important more items than a customer in the US. Merchants can also reduce the likelihood an issue with a DDU shipment by displaying a disclaimer warning on the shopping cart checkout page and requiring both an email address and phone number for the recipient for customs agents to reach out to in order to clear a shipment.

5 Logistics

5 Logistics